46+ is there a cap on mortgage interest deduction

Web The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply since the 2017 tax overhaul enacted both direct and. Compare Best Mortgage Lenders 2023.

Understanding The Mortgage Interest Deduction With Taxslayer

Ad Get All The Info You Need To Choose a Mortgage Loan.

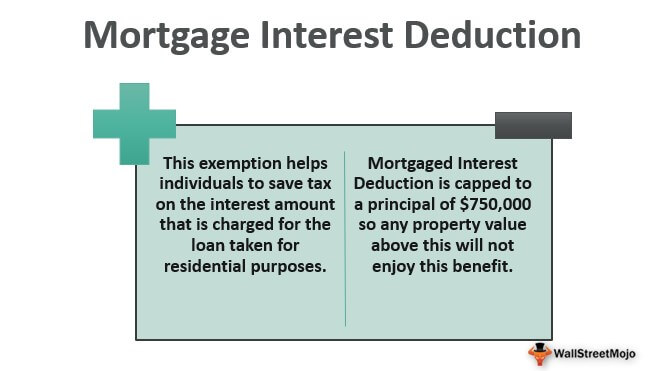

. Web Basic income information including amounts of your income. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. The indirect changes were more important.

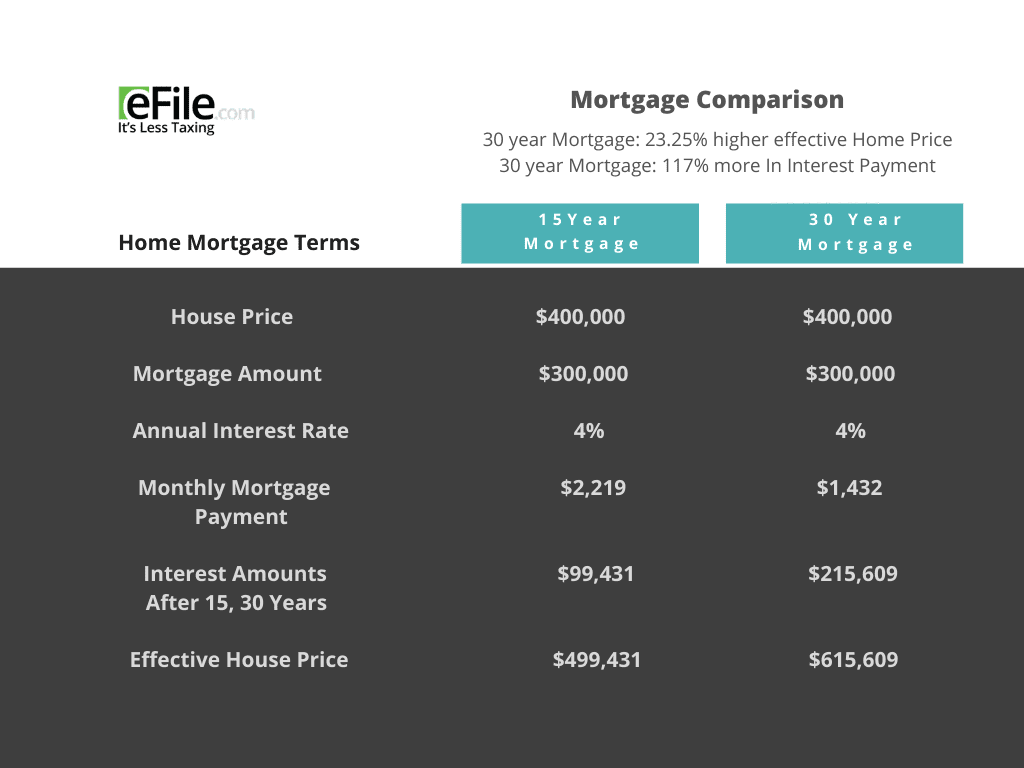

An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage. Web The standard deduction for tax year 2022 is 12950 for single filers and 25900 for married taxpayers filing jointly. Choose The Loan That Suits You.

That means that the mortgage interest you. Web Part of the reduction was direct. Web The mortgage interest deduction means that mortgage interest paid on the first 1 million of mortgage debt can be deducted from your taxes through 2025.

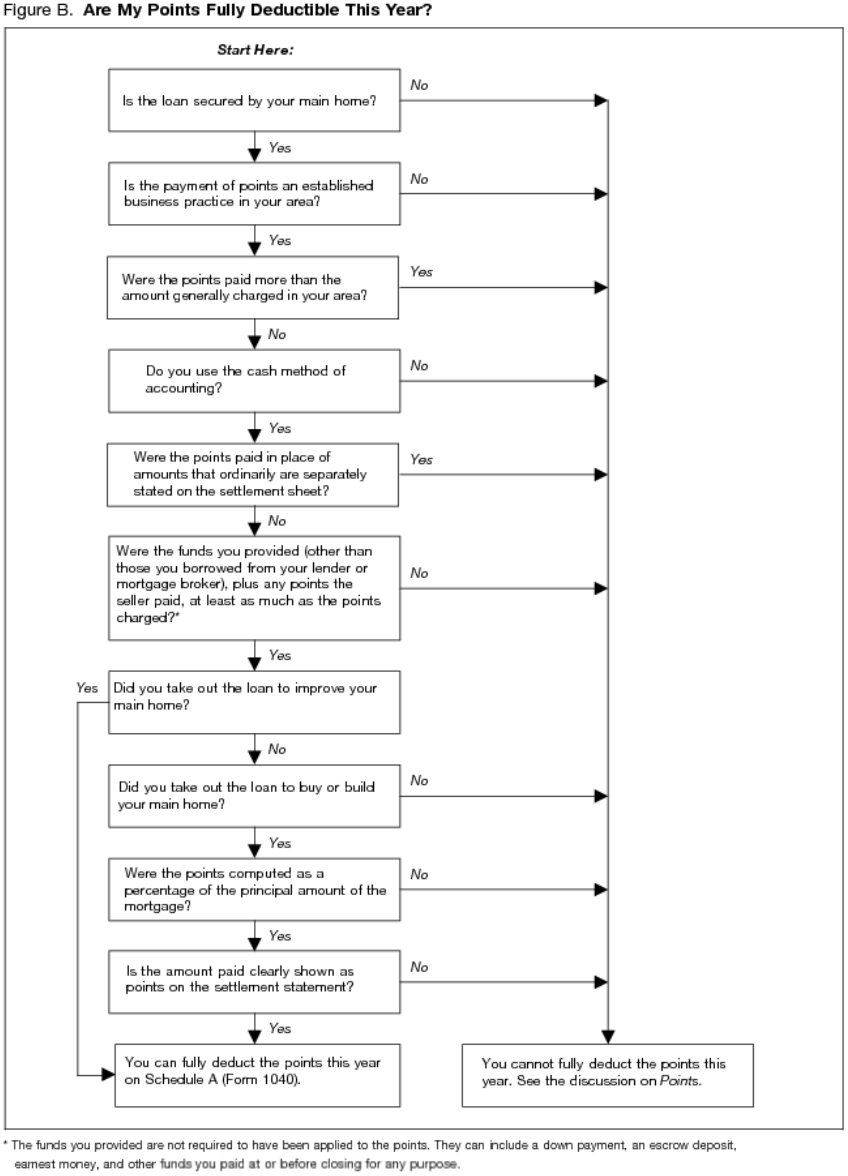

If you live in an area. Web Key Takeaways. Web Important rules and exceptions.

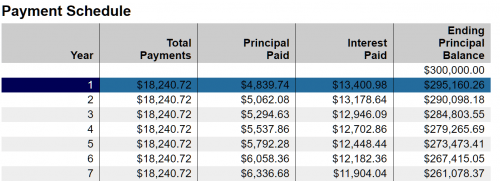

Web The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to 750000. Apply Online Get Pre-Approved Today. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1.

Web Under the new tax law homeowners can only deduct mortgage interest paid on up to 750000 on a first or second home. For property owners who purchased homes prior to Dec. 14 2017 interest is deductible for mortgages up to 1 million or.

Ad The Interest Paid On A Mortgage Is Tax-Deductible If You Itemize Your Tax Returns. Web For 2021 tax returns the government has raised the standard deduction to. Married filing jointly or qualifying widow.

Limiting deductible interest to 750000 of new mortgage debt. The Tax Cuts and Jobs Act TCJA lowered the dollar limit on residence loans that qualify for the home mortgage interest deduction. This new law only applies to homes.

Web The mortgage interest deduction. Homeowners who bought houses before. Single or married filing separately 12550.

Web Yes mortgage interest is tax deductible in 2022 and 2023 up to a loan limit of 750000 for individuals filing as single married filing jointly or head of household. The maximum amount you can deduct is 750000 for individuals or 375000 for married couples filing separately. This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes.

For taxpayers who use. Web If you take out a mortgage in 2018 for a home that costs 1 million you could potentially deduct interest on only the first 750000 of that loan.

Mortgage Interest Tax Deduction Smartasset Com

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

Maximum Mortgage Tax Deduction Benefit Depends On Income

It S Time To Repeal The Home Mortgage Interest Deduction Niskanen Center

Business Succession Planning And Exit Strategies For The Closely Held

Home Mortgage Loan Interest Payments Points Deduction

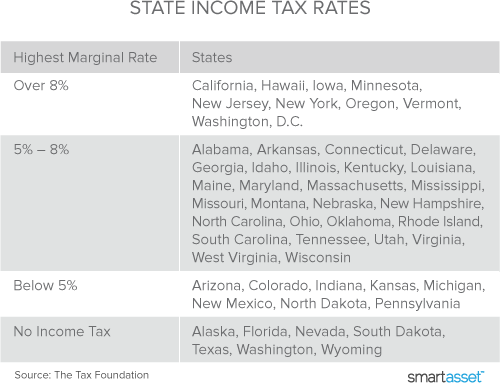

Which States Benefit Most From The Home Mortgage Interest Deduction

Rent Adjustment Commission California Tenant Law

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

Mortgage Interest Deduction How It Calculate Tax Savings

Book Of Proceedings Imksm20132 Pdf

Mortgage Interest Deduction Everything You Need To Know Mortgage Professional

Mortgage Interest Deduction Or Standard Deduction Houselogic

How The Big 6 Tax Plan Would Downsize The Mortgage Interest Deduction

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Mortgage Interest Deduction Bankrate